8 June 2022

Various socio-economic factors can cause stock markets to fluctuate. Are you concerned about their evolution? It’s perfectly normal. Our advisor Maxime Garneau is there to help you.

As in all kinds of situations, avoid making impulsive decisions; otherwise, you may end up on an emotional roller coaster! Here is what could happen with your investments if you let your emotions run the show.

As with all situations, it is best to avoid making impulsive decisions and being at the mercy of your emotions.

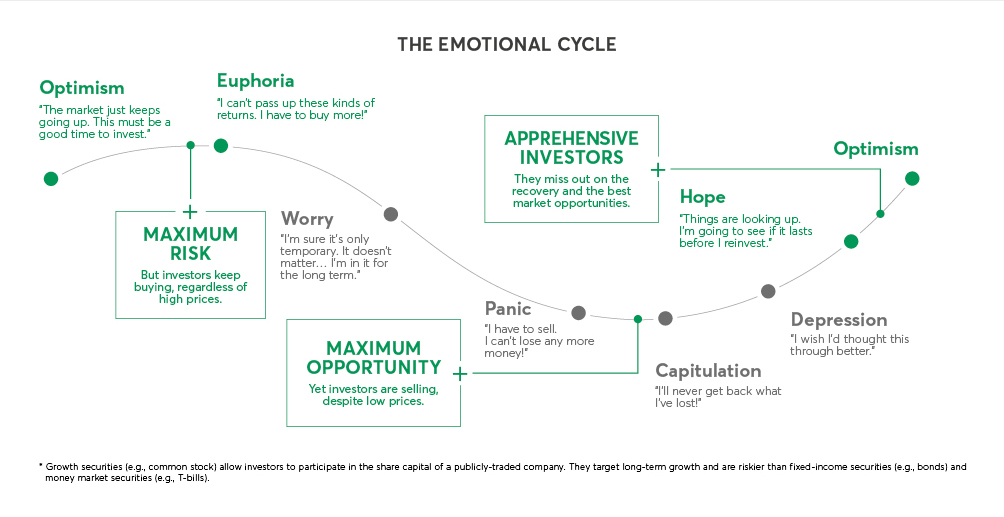

The curve below represents stock market fluctuations. We have summarized how most growth stock investors typically react at each stage. *

When it comes to investing, emotions make poor financial advisors. During market downturns, the optimism investors may have felt when things were looking good can quickly turn to worry—to the point where some of them panic, give in and sell their stock. But that’s how they miss out on market recovery opportunities.

By choosing logic over emotion, you can break free from the current cycle faster and end up in a better financial position. In other words, staying calm and positive is a wise investment strategy—that is why it’s important to never lose sight of your most valuable asset: your long-term vision.

If you need advice, please contact us by email at christina.hyppolite@desjardins.com. We are here for you!

Source : Desjardins blog